The global shipping industry continues to navigate a complex landscape shaped by both environmental challenges and geopolitical tensions. As we close into the end of the second quarter of 2024, the sector remains influenced by the significant disruptions experienced in the previous quarter. The early arrival of the rainy season has brought some relief to the drought-stricken Panama Canal, allowing for an increase in transit capacity. However, ongoing geopolitical tensions in the Red Sea region and other logistical challenges persist. This article offers a detailed overview of the key developments and trends in global shipping during Q2 2024, focusing on how the industry is adapting to these evolving circumstances and what lies ahead.

Summary of key ongoing developments

Panama Canal Drought

Photo: Red cargo ship transits through Gatun Locks, Panama Canal. Credit: M. Timothy O'Keefe / Alamy Stock Photo

Photo: Red cargo ship transits through Gatun Locks, Panama Canal. Credit: M. Timothy O'Keefe / Alamy Stock Photo

The Panama Canal, a crucial artery for global trade, faced significant operational disruptions due to severe drought and El Niño conditions in the first quarter of 2024. These conditions had previously reduced the canal's transit capacity to as low as 17 slots per day, well below its typical capacity of 34-36 vessels. However, with the early onset of the rainy season, there has been a marked improvement in water levels at Gatun and Alajuela Lakes. This positive development has allowed the Panama Canal Authority (ACP) to gradually increase the number of daily transits.

As of late May, the number of daily transits through the Panamax Locks increased from 17 to 24, and the Neo-Panamax Lock from seven to eight, bringing the total to 32 vessels per day. This number is expected to rise further, with daily transits projected to reach 33 by mid-July and 34 by late July. The ACP has also announced an increase in the maximum authorized draft for larger vessels, first to 45 feet and then to 46 feet by mid-June. These adjustments indicate a near return to pre-drought operational levels, offering much-needed relief to global shipping routes that rely heavily on the Panama Canal.

Geopolitical Tensions in the Red Sea

The situation in the Red Sea continues to deteriorate with escalating violence and increasing threats to maritime security. Yemeni Houthi forces have intensified attacks on vessels, aiming to support Palestinians and pressure Israel to end its operations in Gaza. These assaults have had devastating consequences, including the sinking of two ships and the loss of innocent lives.

Leading industry groups, including the World Shipping Council, European Community Shipowners’ Associations, and Asian Shipowners’ Association, have called for international intervention. They decry the violations of navigation freedom and highlight the peril faced by seafarers. The sinking of the Greek-owned coal carrier MV Tutor, resulting in the likely death of a crew member, underscores the human toll. This follows the earlier sinking of the British-registered vessel Rubymar in March 2024, marking a troubling pattern.

Photo: A handout picture provided by the Yemeni Al-Joumhouriya TV on February 26, 2024, shows the Rubymar cargo ship sinking off the coast of Yemen. (Al-Joumhouriya TV/AFP)

The Houthi insurgency has made the Red Sea perilous for shipping activities. Major companies like Maersk and Hapag Lloyd are rerouting vessels around the southern tip of Africa, significantly extending transit times and increasing operational costs, leading to a substantial rise in freight rates. As of June 2024, the composite cost of shipping a 40-foot container on major East-West routes has surged to $5,117, a 233% increase from the previous year.

These diversions are causing congestion at ports across Asia and Europe, notably in Singapore, Malaysia, Shanghai, and Barcelona. This congestion leads to delays and cancellations, complicating global supply chains and potentially causing shortages during peak shopping seasons.

Impact of recent developments on global shipping

Rising Ocean Freight Rates

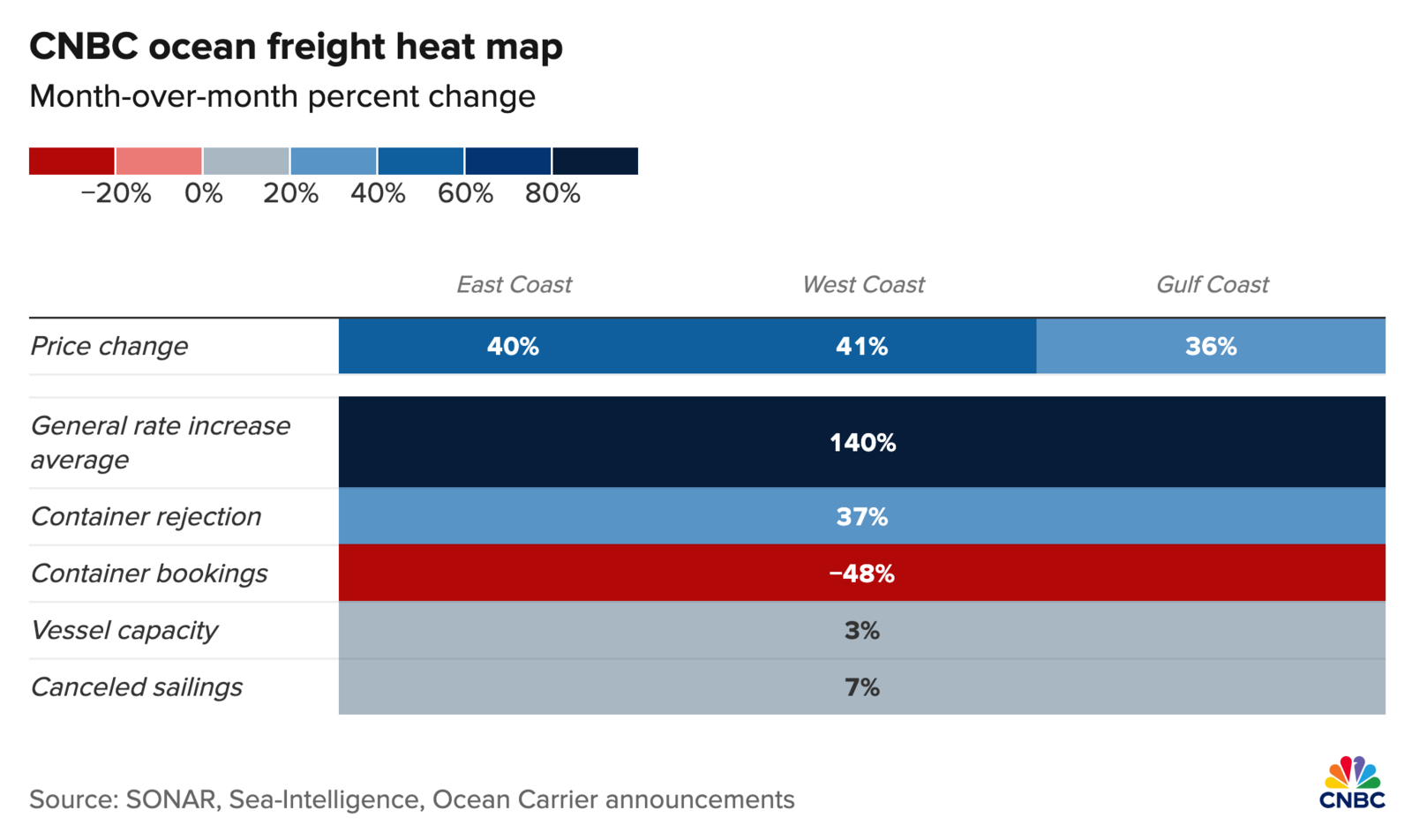

The second quarter of 2024 has seen significant turbulence in global shipping, notably marked by unprecedented spikes in ocean freight rates. According to recent reports, spot rates from the Far East to major destinations like the U.S. and Europe have surged by as much as 36% to 41% month-over-month. The cost of a 40-foot container has skyrocketed to approximately $12,000, approaching levels last seen during the peak of the Covid-19 pandemic.

Analysis of Recent Spikes in Ocean Freight Rates

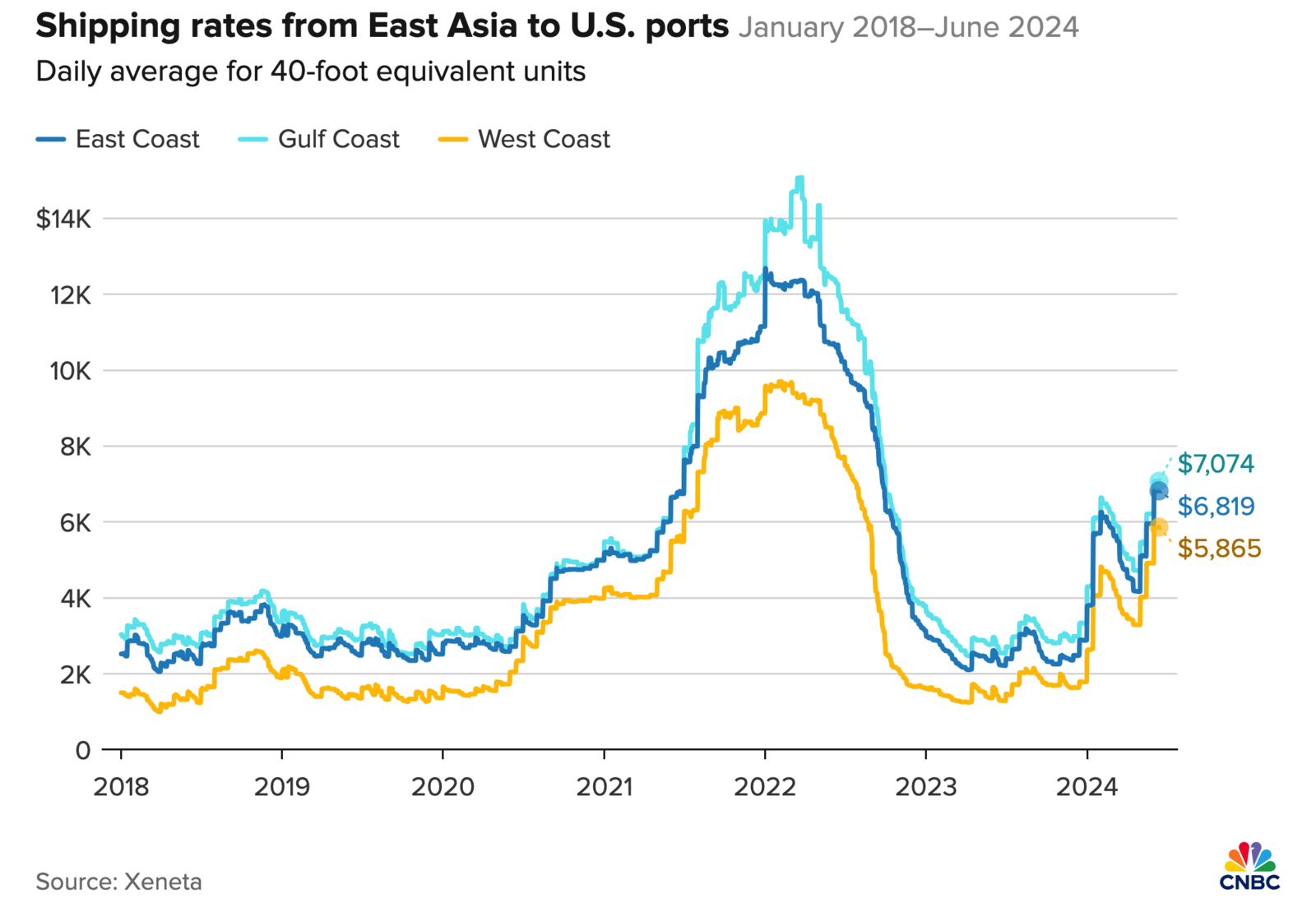

The sharp escalation in ocean freight rates is primarily driven by severe supply chain disruptions and a persistent shortage of containers and vessel capacity. Factors such as extended dwell times at port terminals and scarcity of empty containers have exacerbated the situation. Recent data illustrates this upward trend starkly. For instance, as of June 12, 2024, ocean rates for shipping from East Asia to the US West Coast increased by 101.5% to $5,865 per FEU, compared to $2,911 per FEU on April 24, 2024. Similarly, rates for the East Asia-US East Coast route rose by 58.8% to $6,819 per FEU from $4,294 per FEU during the same period. Rates to Gulf coast jumped by 50% to $7,074 per FEU from $4,716 per FEU, underscoring the dramatic increases across key trade lanes.

Comparison with Historical Benchmarks

Comparing the current rate dynamics with historical benchmarks reveals striking parallels to the challenges faced during the post-Covid era. Experts warn that rates could potentially reach or even exceed the Covid-era peak of $30,000 per container by early 2025, particularly if supply chain constraints and geopolitical tensions persist. This projection is bolstered by the fact that spot rates in some cases are already nearing pre-pandemic levels, indicating a return to heightened pricing pressures reminiscent of the 2020-2021 period.

Port Congestion and Equipment Shortages

Port congestion and equipment shortages continue to present significant challenges for global shipping, impacting operational efficiency and escalating costs.

Examination of Port Congestion Issues

Many major ports, including those in North America, Europe, and Asia, are experiencing severe congestion. Factors contributing to this include increased trade volumes, labor shortages, and infrastructural bottlenecks. Ports like Los Angeles and Long Beach have reported extended wait times for vessels, with some ships waiting up to two weeks for a berth.

Analysis of Equipment Shortages

The shortage of critical shipping equipment, such as containers and chassis, further compounds the congestion issues. This shortage is largely driven by imbalances in container flows, with a significant number of empty containers stranded in non-exporting regions. The resulting equipment scarcity has forced shipping lines to implement surcharges and prioritize more lucrative routes, disrupting the global supply chain further.

Supply Chain Disruptions

The global shipping industry continues to grapple with profound supply chain disruptions that are impacting operations across different continents. Key factors contributing to these disruptions include port congestion, delays in vessel operations, and logistical bottlenecks at major trade hubs.

Impact on Global Trade and Supply Chains

The combined effect of port congestion and equipment shortages is significantly disrupting global trade flows. Industries reliant on just-in-time delivery models, such as automotive and electronics, are particularly affected. The delays and increased costs are causing manufacturers to reconsider their supply chain strategies, with some opting for nearshoring or diversifying their supplier base to mitigate risks. This may also be putting pressure on many shippers to move seasonal goods now before rates climb further or to avoid delays later in the year, which could threaten inventory availability in Q4. Apprehensions regarding a potential labor strike at ports along the East Coast and Gulf regions in October are also influencing the situation. Furthermore, several transpacific carriers have already reached full capacity bookings extending through July.

The ripple effects of supply chain disruptions are felt across various industries, affecting the timely delivery of goods and exacerbating inflationary pressures. Port congestion at critical hubs like Singapore and delays in container movements have further strained global supply chains.

Shipper Strategies

Shippers are adjusting their strategies to cope with the increased demand and limited capacity. Some are opting to ship goods earlier than usual to avoid the peak season rush and potential rate hikes. This proactive approach is driven by the need to secure inventory availability for Q4, as well as to mitigate the risks associated with potential labor strikes and fully booked carriers.

Analysis of Regional and Industry-Specific Impacts

Different regions and industries are experiencing varied impacts from supply chain disruptions. For instance, the apparel and electronics sectors are particularly vulnerable due to their reliance on timely shipments and just-in-time inventory models.

Conclusion

In conclusion, the global shipping industry in the second quarter of 2024 remains at a critical juncture, navigating through a landscape fraught with challenges. Despite the Panama Canal's gradual recovery from severe drought conditions, ongoing geopolitical tensions in the Red Sea continue to disrupt major trade routes, leading to reroutings and substantial cost escalations. The surge in ocean freight rates, reminiscent of peak pandemic levels, underscores the industry's volatility and the persistent impacts of supply chain disruptions and port congestion worldwide.

Looking ahead, stakeholders must remain vigilant as uncertainties loom, potentially exacerbating inflationary pressures and straining global supply chains further. As the sector adapts to these evolving dynamics, strategic resilience and international cooperation will be pivotal in mitigating risks and fostering sustainable growth in the months to come.