As 2023 marked a welcome return to pre-pandemic schedule reliability, the closing quarter brought unexpected challenges, casting a shadow of uncertainty over the new year. The initial disruptions triggered by the Panama Canal Drought were compounded by the escalation of the Israel-Gaza conflict, setting off a chain reaction. Tensions in the Southern Red Sea region, especially concerning assets with ties to Israel, have reached unprecedented levels. The upswing in geopolitical unrest has infused a climate of uncertainty and unpredictability among global shippers, exacerbating disruptions across the entire shipping industry.

From route diversions to widespread delays and escalating ocean freight rates, the industry is contending with a multifaceted challenge that echoes across international waters for the year to come.

Q4 2023 in summary

Drought of Panama Canal

Disruptions at the Panama Canal have presented significant challenges to the global shipping industry, triggered by a combination of environmental and geopolitical factors. The industry has been compelled to adapt swiftly, resulting in a consequential impact on freight rates and the reconfiguration of global trade routes and logistics.

Ms. Chara Georgousi, a Research Analyst at Intermodal, shed light on the evolving trends in cargo transit through the Panama Canal in recent years. In 2021, the canal efficiently managed approximately 290 million LT of cargo, a figure that saw an increase to about 294 million LT in 2022, according to official statistics from the Panama Canal Authority. However, the year 2023 presented a significant challenge due to a severe drought, causing a substantial decrease in the canal's transit capacity and an estimated drop in cargo transit to around 285 million LT.

The drought and El Niño conditions forced a substantial reduction in transits, plummeting to as low as 18 slots per day, representing between 40% and 50% of full capacity. Under normal circumstances, the canal handles between 34 and 36 vessels daily. This environmental challenge has adversely affected the canal's operational efficiency, prompting vessels to choose longer and costlier routes, disrupting traditional trade flows.

For instance, MSC has implemented a $297/Container Panama Canal Surcharge for transits since December 15, and Hapag Lloyd initiated a $130 surcharge starting January 1, 2024. Prominent shipping alliances are adjusting their networks, and various services from Asia to the East Coast of the US are choosing routes through the Suez Canal instead of the Panama Canal. However, due to the developing situation in the Red Sea, traffic on this route is being reduced.

Geopolitical tensions in the Red Sea and a new Suez Canal crisis

The attacks began in November 2023 when the Galaxy Leader, a carrier partially owned by an Israeli businessman, was hijacked by the Houthi militia. The hijackers seized control of the ship and held 25 crew members hostage. Subsequent incidents have unfolded in and around the southern Red Sea region, Gulf of Aden, and the Arabian Sea. The attacks by the militia off the coast of Yemen have prompted container carriers to advocate for political intervention, prompting both the USA and the UK to bolster their military presence in the strait. This, in turn, has led to the interception of missiles and Unmanned Aerial Vehicles (UAVs), accompanied by retaliatory strikes against the Houthis by the navies of the US and UK. The militia, in response, insists that attacks will persist until Israel ceases its military operations in the Gaza Strip.

Ms. Georgousi highlighted the increasing challenges facing the Suez Canal, a vital maritime passage that experienced heightened strain in 2022. Around 23,000 vessels, carrying a total of 1.4 billion tons of cargo, transited the canal—a substantial increase from the 21,700 vessels and 1.27 billion tons recorded in 2021. However, recent ship attacks have elevated security concerns, rendering the canal a less viable route for goods transportation. Shippers are grappling with rising rates, extended transit times, and anticipated delays expected to persist.

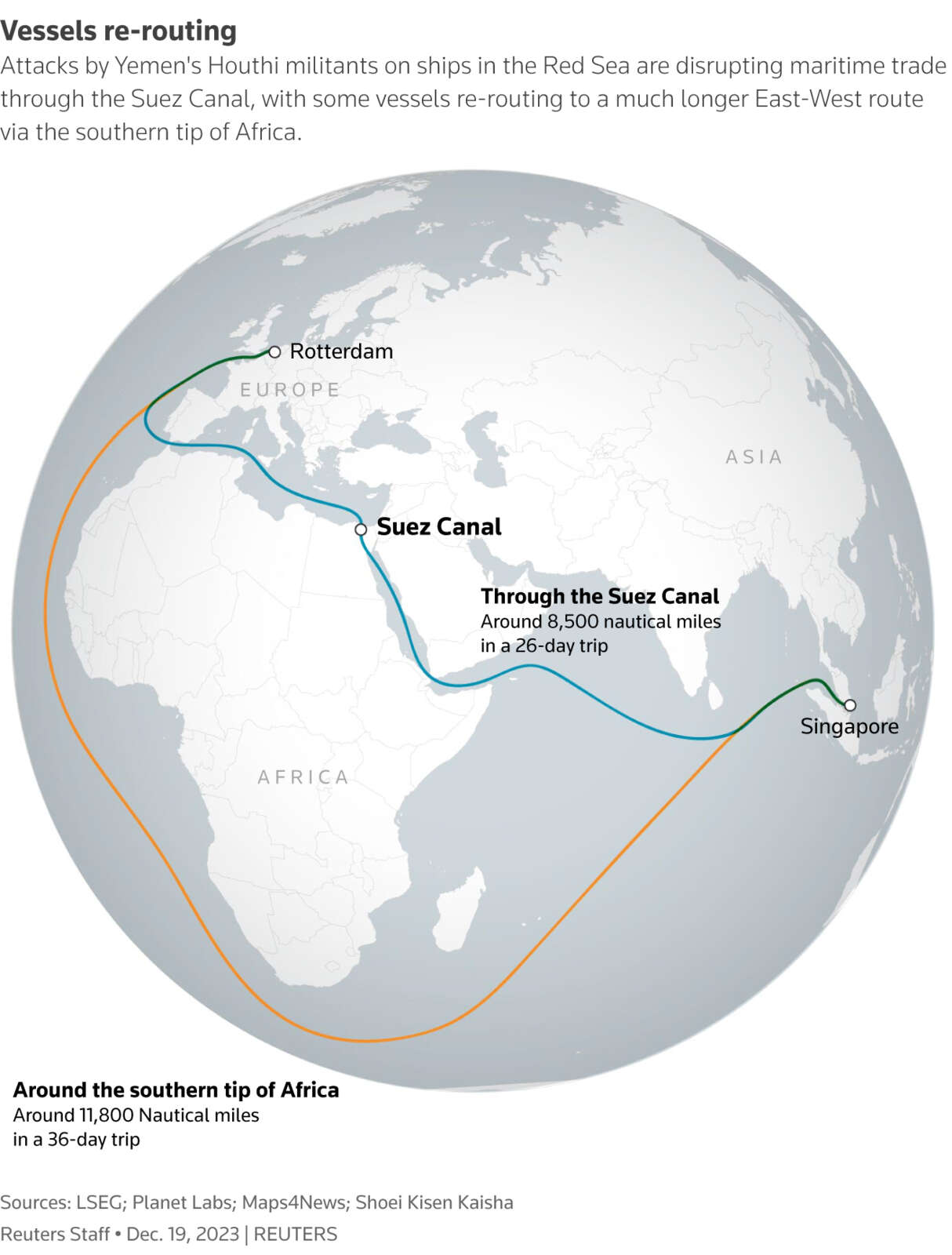

As a result, major container carriers have temporarily suspended services through the Red Sea, including the Suez Canal, as this particular area serves as the gateway to the canal. According to Freightos, the diverted fleet from these carriers accounts for 62% of global capacity. Ships carrying various goods, from furniture and apparel to food and fuel, are now taking the longer route around Africa via the Cape of Good Hope.

However, this alternative is both costly and significantly impacts total transit times, adding approximately 4,000 nautical miles and 10 days to each voyage.

The current situation in Q1 2024

January 2024

The Red Sea situation remains precarious, with little improvement observed in navigation safety. Ocean carriers continue opting for the longer Cape of Good Hope route, while the military intervention in Yemen has heightened the frequency of vessel attacks, expanding the risk area to now include the Gulf of Aden.

The volume of container vessels traversing the Suez Canal has decreased by more than 66% since the onset of the attacks. Between early December 2023 and March 2024, an estimated 7,565 container ships are believed to have opted for alternative routes around Africa, as analyzed by the supply chain platform project 44.

This extended and costlier journey for Asian container trade bound for European, Mediterranean, and North America East Coast destinations is contributing to a surge in freight rates. New base prices and surcharges were introduced in January, further amplifying the economic impact.

Freightos Terminal data in January 2024 indicates a substantial surge in shipping rates. The rates from Asia to North Europe have experienced a remarkable increase of 173% compared to the period just before the diversion announcements, reaching over $4,000/FEU. Similarly, prices for the Asia to Mediterranean route have doubled, surpassing $5,000/FEU. It's worth noting that these current rates are more than double those observed in January 2019. Carriers have also introduced surcharges, ranging from $500 to as much as $2,700 per container, amplifying the overall costs borne by shippers.

Rates for shipments to North America's East Coast have seen a 52% rise, reaching $3,900/FEU, which is 30% higher than the rates in 2019. Some carriers had implemented notable surcharges imposing $500/FEU surcharges for all Asia to North America shipments in the earlier part of this year. Prices to the West Coast have also surged significantly, increasing by over $1,000 per container to $2,713/FEU, possibly indicating an anticipated shift in demand to the West Coast to circumvent the increased transit time to the East Coast.

Taking into account these additional charges, if the total prices were to fall between $5,000 and $8,000 per container for these prominent trade lanes starting from Asia, these rate tiers would exceed the usual levels for this period by 2.5 to 4 times. However, in contrast to the pandemic years, carriers currently possess the necessary capacity to manage diversions, and demand is anticipated to hover around pre-pandemic levels. The prolonged transits, accompanied by additional costs and capacity allocation, are expected to drive up rates significantly. Yet, even at the range of $5,000-$8,000/FEU, prices for shipments from Asia to North Europe and the Mediterranean would still be considerably lower—falling between 45% and 65% below their peak of $14,000/FEU during the late 2021 pandemic and 65% to 75% lower than the peak of $22,000/FEU for the Asia to North America East Coast route.

February 2024

Amidst the ongoing developments in the Red Sea region, the maritime shipping sector has encountered heightened pressure coinciding with the Lunar New Year. Within a brief span, ocean freight rates from Asia to North America witnessed a significant surge, with rates to the West Coast rising by over 45% to surpass the $4,000/FEU threshold. Rates to the East Coast escalated by 50%, reaching approximately $6,000 per FEU. Similarly, rates from Asia to North Europe and the Mediterranean have surged to around $5,500/FEU and $6,500/FEU, respectively.

To address these challenges, carriers are swiftly adapting to accommodate the newly established longer routes and enhance reliability in the ensuing weeks. Despite the announcement of general rate increases (GRIs) and surcharges for February, it appears that freight rates may be nearing their peak, especially considering the impending Lunar New Year shipments.

March 2024

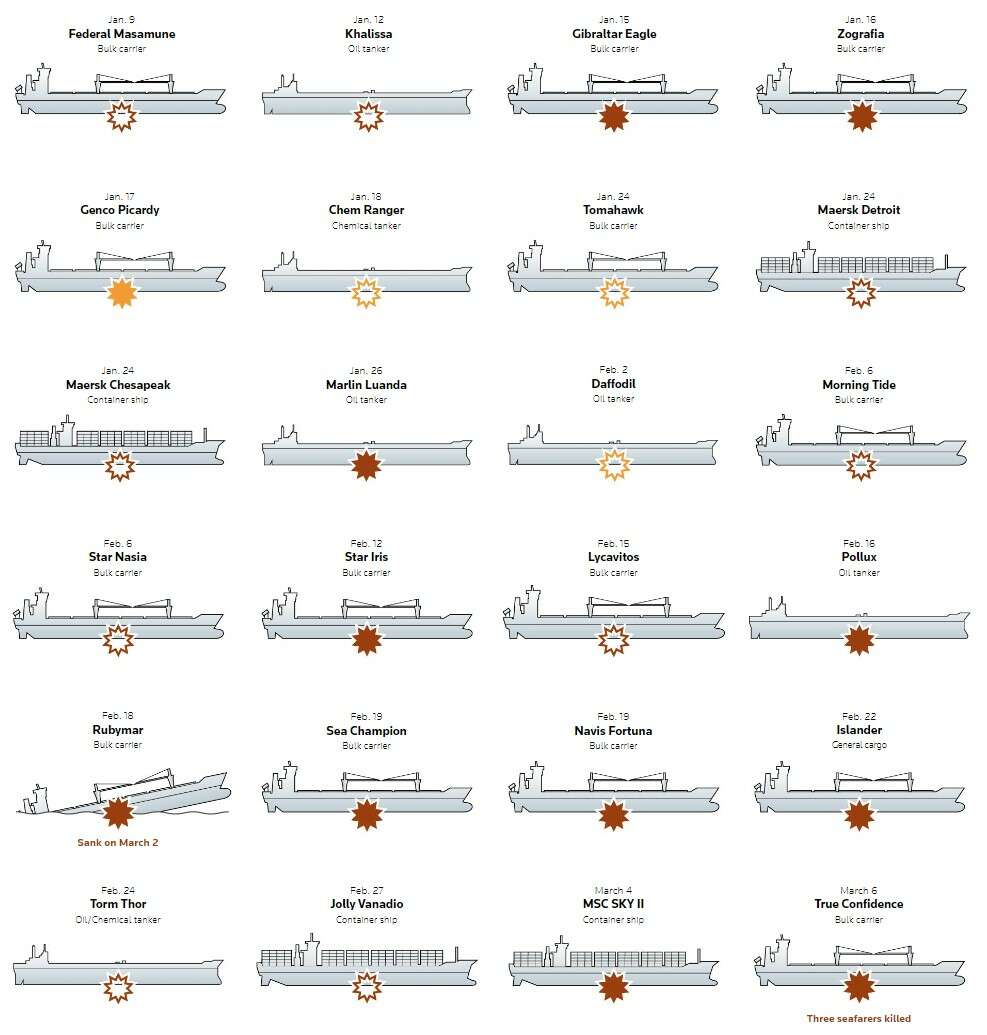

The Transpacific Maritime Conference (TPM) began amidst reports of another container ship struck by a missile, along with significant developments such as the first sunken vessel and Houthi demands for ships to obtain permits for traversing Yemeni waters.

An environmental crisis looms following the sinking of a bulk carrier, laden with 21,000 tons of fertilizer and leaking bunker fuel due to Houthi missile attacks in late February. Empowered by their first ship sinking, the Houthis now demand that ships seeking passage through their waters acquire permits from Yemen's Houthi-controlled Maritime Affairs Authority. These waters encompass half of the crucial Bab al-Mandab strait, a pivotal maritime passage.

The Houthi insurgency persists, vowing continued operations in the Red and Arabian Seas, the Gulf of Aden, and Bab al-Mandab until the blockade on Gaza is lifted. Over the past five months, more than 60 ships have fallen victim to Houthi attacks since the outbreak of hostilities between Israel and Hamas.

Former CIA chief Robert Gates has speculated that Houthi attacks may persist despite a potential ceasefire between Israel and Hamas, while the industry as a whole adapts to this new reality.

Regarding freight rates, shippers acknowledge that surcharges and rate hikes in January and February were somewhat exaggerated but generally accepted due to the uncertainty surrounding diversions and the extensive adjustments carriers had to make. However, with the slow season for ocean freight underway and carriers having made necessary adjustments, there is consensus among shippers that rates need to decrease from recent highs.

While freight rates remained stable overall last week, rates are expected to continue falling on the Asia-N. Europe and Mediterranean lanes, with prices from Asia to N. America also showing meaningful declines.

Ocean freight rates from Asia to North America have decreased by 10% from their peak, while prices from Asia to North Europe are 22% lower, and rates from Asia to the Mediterranean have dropped by 34% compared to their peak in late January. The disruption in the Red Sea significantly impacted ocean logistics out of India; however, rates on this route are beginning to decline, with some carriers postponing planned surcharges or increases for March.

During the TPM conference, Alan Murphy of Sea Intelligence estimated that rates should stabilize at around 1.5 to 2 times above the long-term average. This suggests that prices still have room to decrease further, considering that rates for Asia to North America West Coast and North Europe are more than triple the levels observed in 2019, while rates for the East Coast and Mediterranean remain more than double.