In the world of international trade, clarity, and precision in defining buyer and seller responsibilities are paramount to successful transactions. This is where International Commercial Terms (Incoterms) come into play. Incoterms are standardized trade terms published by the International Chamber of Commerce (ICC), outlining the obligations and risks associated with the delivery of goods between buyers and sellers.

In this article, we will delve into the significance of Incoterms in international trade, explore common Incoterms such as EXW, FOB, CIF, and DDP, and provide practical examples to illustrate their impact on import-export operations.

Understanding incoterms

Explanation of Incoterms

Incoterms are a set of internationally recognized trade terms that define the respective obligations, costs, and risks of the buyer and seller in a transaction. They provide a common language for parties involved in international trade, ensuring clarity and consistency in contractual agreements. Incoterms specify who is responsible for tasks such as transportation, insurance, customs clearance, and delivery, from the point of origin to the point of destination.

The International Chamber of Commerce (ICC) introduced the Incoterms rules for the first time in 1936, establishing them as the universally recognized standard for interpreting trade terms in global commerce. Since 1980, the ICC has periodically reviewed and revised these rules every decade to ensure their alignment with current trade practices. The most recent iteration, Incoterms 2020, came into effect on January 1, 2020, and will remain applicable until 2030.

It's important to note that older versions of the Incoterms rules may still be referenced in some documents, underscoring the necessity for contracts to explicitly specify the edition being utilized.

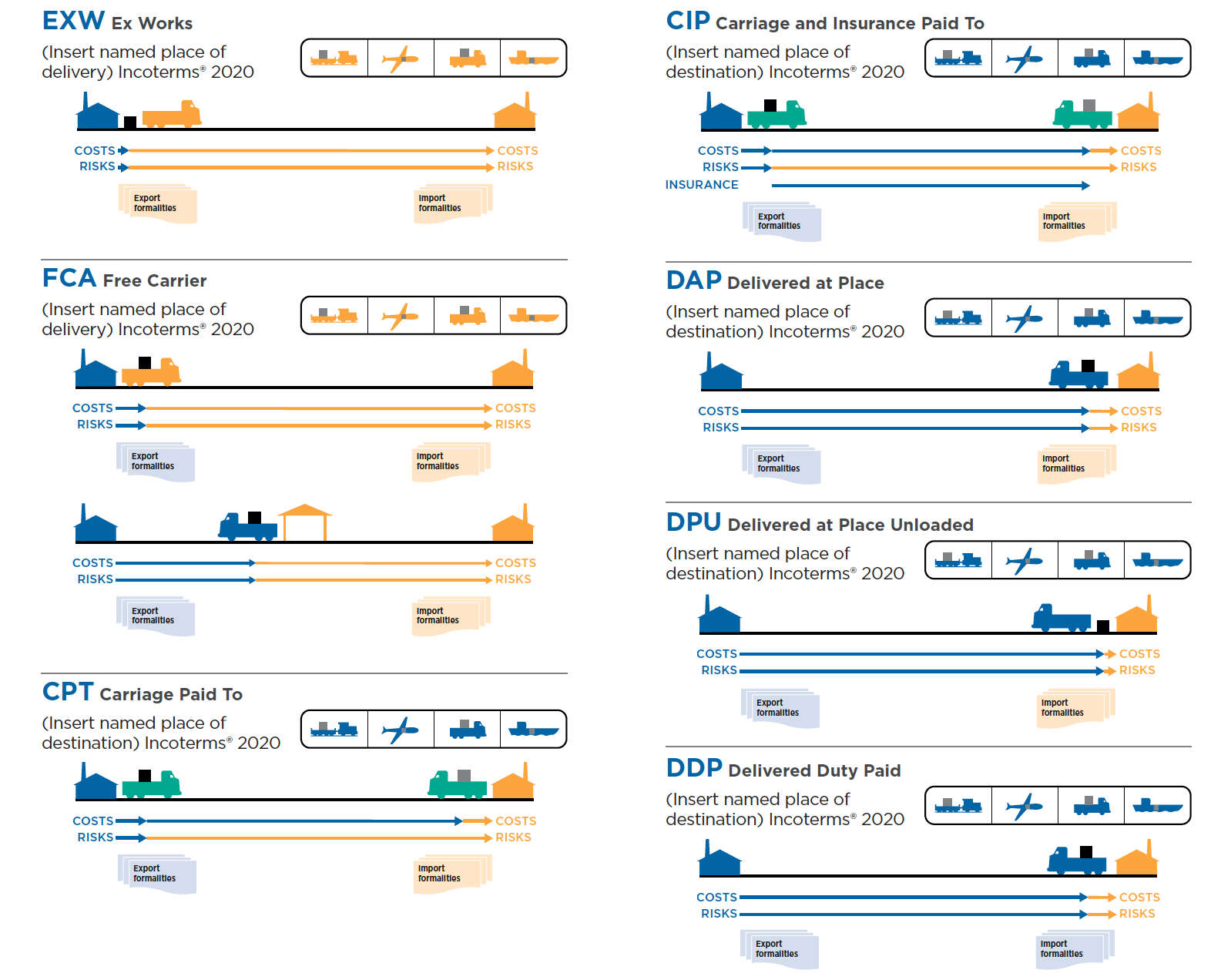

Among the 11 rules, seven are designated for any mode(s) of transportation, while the remaining four are specifically tailored for Sea, Land, or Inland Waterway transport.

7 Incoterms 2020 rules for ANY mode(s) of transport:

Source: International Chamber of Commerce (ICC)

- EXW (Ex Works): Under EXW terms, the seller fulfills its obligation by making the goods available at its premises. The buyer is responsible for all transportation costs, export clearance, and import duties. EXW is often used when the buyer has full control over the logistics process and wants to minimize seller involvement.

- FCA (Free Carrier): FCA terms indicate that the seller fulfills their obligation to deliver when they hand over the goods, cleared for export, to the carrier or another person nominated by the buyer at the seller's premises, or another named place. The buyer is responsible for the main carriage, but the seller must arrange transportation and load the goods onto the buyer's carrier.

- CPT (Carriage Paid To): Under CPT terms, the seller is responsible for delivering the goods to the agreed-upon destination. The seller arranges and pays for transportation to transport the goods to the named destination, but the risk transfers to the buyer upon delivery to the carrier.

- CIP (Carriage and Insurance Paid To): CIP terms are similar to CPT but include the additional obligation of the seller to procure insurance against the buyer's risk of loss of or damage to the goods during carriage. The seller contracts for insurance and bears the costs, ensuring coverage until the goods are delivered to the carrier.

- DAP (Delivered at Place): Under DAP terms, the seller bears all risks and costs associated with delivering the goods to the agreed-upon destination. This includes transportation and any applicable import duties or taxes. However, the seller is not responsible for unloading the goods from the arriving means of transport.

- DPU (Delivery at Place Unloaded): DPU terms are similar to DAP but require the seller to unload the goods at the named place of destination. The seller assumes all risks and costs until the goods are unloaded at the designated delivery point.

- DDP (Delivered Duty Paid): DDP terms represent the highest level of obligation for the seller. The seller bears the responsibility of delivering the goods to the destination specified by the buyer, ensuring that they are cleared for import and prepared for unloading. This includes paying all applicable duties, taxes, and customs clearance fees.

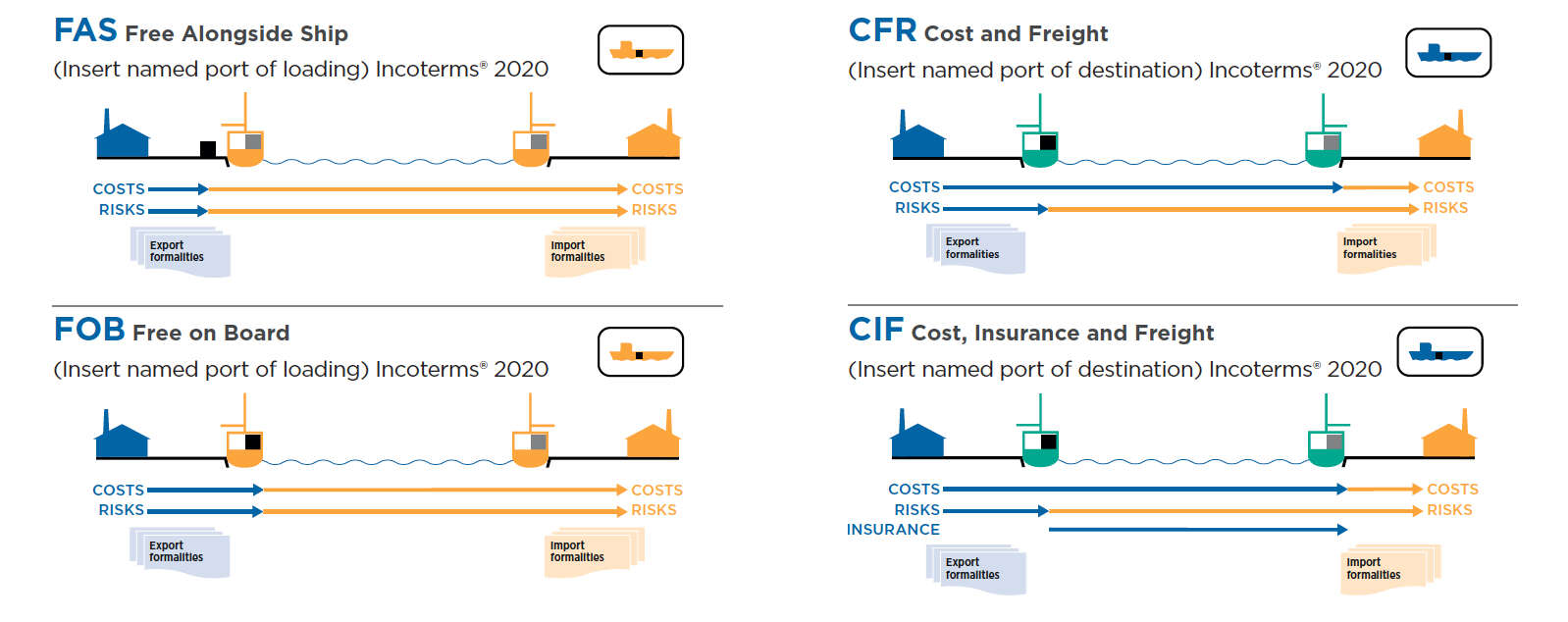

4 Incoterms 2020 rules for SEA, LAND, or INLAND WATERWAY mode(s) of transport

Source: International Chamber of Commerce (ICC)

- FAS (Free Alongside Ship): FAS terms stipulate that the seller delivers the goods alongside the vessel at the named port of shipment. The seller assumes responsibility and costs until the goods are placed alongside the ship, cleared for export. Once the goods are delivered alongside the vessel, the risk transfers to the buyer.

- FOB (Free on Board): FOB terms require the seller to deliver the goods on board the vessel nominated by the buyer at the named port of shipment. The seller is responsible for all costs and risks until the goods are loaded onto the vessel. FOB is commonly used for sea freight shipments.

- CFR (Cost and Freight): CFR terms require the seller to deliver the goods on board the vessel at the named port of shipment. The seller is responsible for the cost and freight to transport the goods to the named port of destination. Yet, the risk shifts to the buyer once the goods are loaded onto the vessel at the port of shipment.

- CIF (Cost, Insurance, and Freight): CIF terms entail the seller delivering the goods on board the vessel, covering the cost of transportation and insurance to the destination port. However, the risk transfers to the buyer once the goods are loaded onto the vessel. CIF is suitable for buyers who want the seller to handle transportation and insurance arrangements.

Practical Examples

Scenario 1:

A buyer in the United States purchases goods from a seller in China under FOB terms. The seller arranges transportation and delivers the goods to the port of Shanghai, where they are loaded onto the vessel. Once loaded, the risk and responsibility transfer to the buyer, who arranges for customs clearance and transportation from the port of discharge to the destination in the United States.

Scenario 2:

A seller in Germany agrees to sell goods to a buyer in France under DDP terms. The seller is responsible for arranging transportation, insurance, and customs clearance, delivering the goods to the buyer's premises in France. The buyer bears no risk or responsibility until the goods are delivered and unloaded.

Scenario 3:

A manufacturer in Japan agrees to sell goods to a distributor in Australia under CIF terms. The manufacturer is responsible for arranging transportation and insurance, delivering the goods to the port of Yokohama. Upon arrival at the port, the goods are loaded onto the vessel bound for Sydney. Once loaded, the risk and responsibility transfer to the distributor in Australia, who is then responsible for customs clearance and transportation from the port of discharge to the final destination in Sydney

Choose the right incoterm rule

When choosing the right Incoterm, there are several factors to consider:

Mode of transport and nature of cargo

If your consignment entails land, air, or containerized transport, it's crucial to note that Incoterms like FAS, FOB, CFR, or CIF are specifically tailored for non-containerized sea freight and may not be applicable.

-

Level of expertise

For those navigating the complexities of international trade and logistics with limited experience, opting for an Incoterm that entails fewer obligations and risks, such as EXW for exporters or DDP for importers, may prove advantageous. - Degree of autonomy

Evaluate your desired level of engagement and control in the shipping process. EXW or FCA Incoterms offer maximum control over carrier selection, expenses, routing, and insurance, particularly beneficial for importers with established logistics partnerships. - Accountability and risk management

Assess the extent of risks you're willing to shoulder and the commitments you're equipped to fulfill, which closely correlate with your chosen level of autonomy. - Insurance considerations

Clarify who will assume responsibility for insuring the goods. It's noteworthy that only CIP and CIF place the onus on the seller to insure the freight, with differing coverage stipulations. Other Incoterms afford flexibility for negotiating insurance terms to align with specific preferences and requirements.

In closing, the significance of Incoterms in international trade cannot be overstated. These standardized trade terms, established by the International Chamber of Commerce (ICC), serve as the bedrock of clarity and reliability in global transactions. By delineating the responsibilities and liabilities of buyers and sellers, Incoterms ensure smooth and efficient trade operations across diverse industries and geographical boundaries.

As businesses navigate the complexities of the global marketplace, the judicious selection of Incoterms becomes imperative. Each term carries distinct implications for risk management, cost allocation, and logistical efficiency. By carefully considering factors such as mode of transport, level of experience, and insurance requirements, stakeholders can tailor their contractual agreements to suit their unique needs and objectives.